The InfraBridge Approach

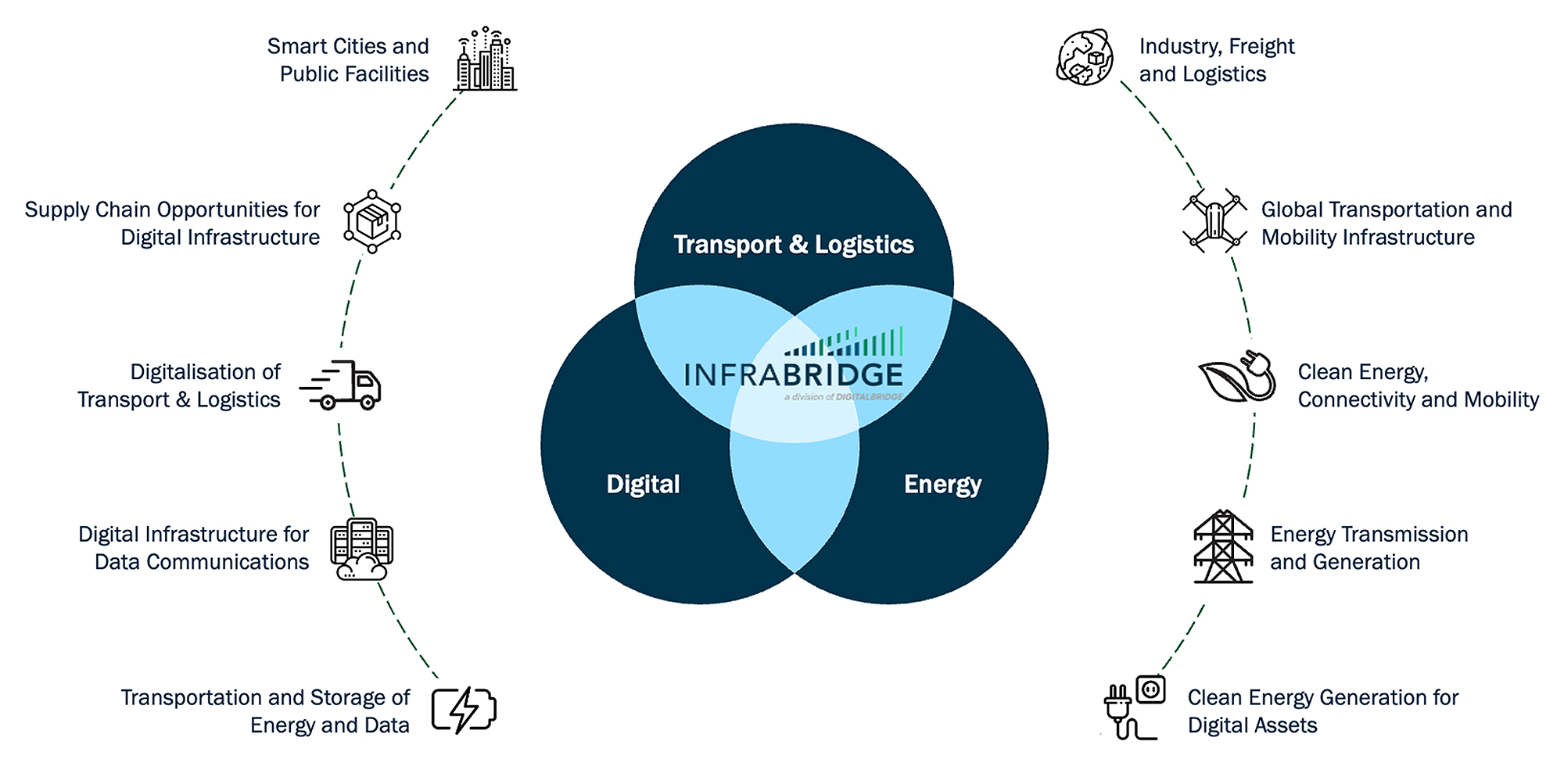

InfraBridge is a diversified middle-market infrastructure manager with a focus on digital infrastructure, transport, logistics and energy transition. Our approach is to drive progress and connectivity by investing in purposeful companies that improve the movement of information, people, and goods.

We use private equity rigor and an active approach to asset management to maximize value and drive returns on behalf of our investors.

InfraBridge is Well Positioned to Capture Megatrends

A Stronger Force for Growth

As AI reshapes the digital economy and the infrastructure landscape, InfraBridge remains at the forefront.

We recognize the evolving nature of infrastructure and the necessity to stay ahead of that evolution. By identifying and investing in the infrastructure of tomorrow, including emerging middle-market digital infrastructure and energy transition opportunities, we promote sustainable growth while positioning ourselves to meet the essential needs of the future.

Our key figures

$ 8.6 bn

in infrastructure equity assets under management

$ 3.7 bn

in fee earning assets under management

14

portfolio company investments

11,000 +

employed by InfraBridge portfolio companies

InfraBridge is a standalone division of DigitalBridge. DigitalBridge (NYSE: DBRG) is a leading global digital infrastructure firm managing a portfolio of digital infrastructure assets on behalf of its investors.

Key figures including AUM, as of June 25, 2025.